In reality, such examples are not uncommon. As a result, Ali carefully "designed" his own partner system and reached a set of voting binding agreements with silver. For example, in the agreement, Softbank Corp. promised to vote for the directors nominated by Ali partners at the shareholders' meeting, and Softbank Corp. would not vote against the director nomination of Ali partners without the consent of Jack Ma and Cai Chongxin. Softbank Corp. also promised to place the voting rights of Ali common shares under the voting trust and be dominated by Ma Yun and Cai Chongxin.

As we all know, the founding team led by Jack Ma holds only a small number of shares in Ali, but firmly holds control of the company through the partnership system. In the Hong Kong stock IPO IPO, Ali has carried on the more detailed disclosure and the update to this situation. From the point of view of equity structure, Softbank Corp. is still the largest shareholder with a 25.8% shareholding ratio. Ma Yun and Cai Chongxin only own 6.1% and 2.0%. It is worth noting, however, that even if Softbank Corp. has always had an advantage, "minority shareholders" such as Ma Yun have absolute control over Ali. This is the strength of Ali's partner system.

The chief science creation officer noted that the "largest shareholder" of Ali is facing a series of events such as successive investment failures and high debt, and at the same time, they are frequently preparing to replicate another Ali that can "make blood" for it. It is well known that Ma Yun and Ali's lives were completely changed because of Softbank Corp. and Sun Justice-without Softbank Corp. 's investment, Ali's development might not have been so rapid, and Ma Yun would not have been at the top of China's rich list many times. However, 20 years later, the relationship between Ali and Softbank Corp. is undergoing subtle changes.

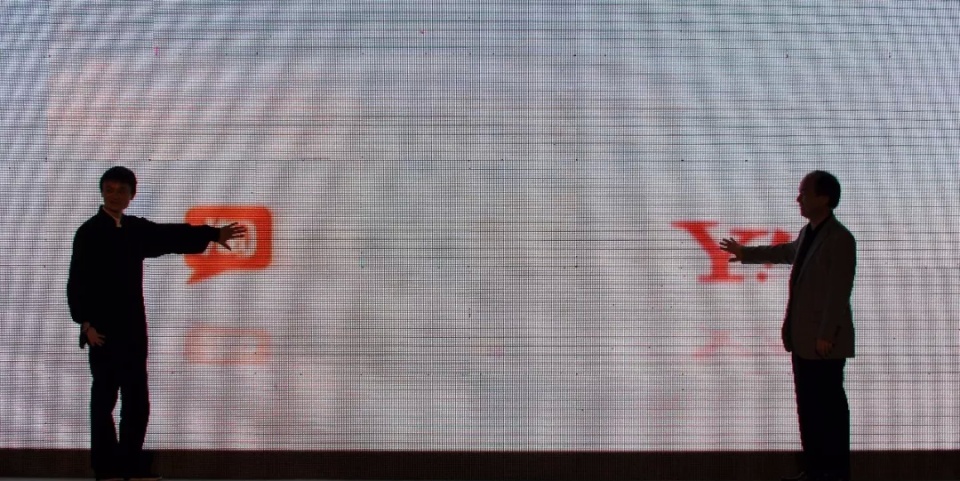

(picture source:搜狗图片)

It can be said that through this system, Ali controls the right of appointment and removal of personnel, formally attributes the control of the company to the core management team, and then determines the operation of the company.

Ali's partner organization "Alibaba Partnership" was set up in July 2010, also called the "Pattner, Lakeside". On the basis of the organization system, all the partners' voting was based on one vote, and it was for this system that the Ali partner had the right to nominate and appoint a director. In fact, in the past few years, Ali has continued to finance the development process. The financing process is the process of continuously diluting the shares held by the company's founder team. In this context, if the operation is carried out in accordance with the general "the same rights of the same unit" rule, when the foreign investor becomes a large shareholder of the company, the founder of the company owns Power, as their holdings are diluted, may run the risk of being driven out of the board by major shareholders.

Behind the 4 trillion giant, Softbank Corp. Group, the largest shareholder in the market capitalization of almost two Meituan Dianping or 2.77 JD.com, has also received renewed attention.

The long-established Alibaba's third ipo has just been completed, with Alibaba's return to the Hong Kong Stock Exchange, which has a market value of up to HK $400 million. In addition, Mr. Ali, who raised more than 88.8 billion Hong Kong dollars, has gone beyond the Asia-Pacific region and has become the world's largest IPO this year. At the end of the year, Alibaba's latest share price was HK $188.5/ share, up 6.99% from its offering, and a market value of HK $4.03 million-twice the value of the current Hong Kong stock and nearly twice the value of China's oil shares.

No one can really see how much of its biggest shareholder, the Japanese SoftBank Group, can make a profit from the Hong Kong Stock Exchange at a market value of HK $400 million. It's almost equivalent to two US-American reviews or 2.8 Jingdong's market value, from the figure itself, It is the result of the soft-silver group's work in the back of Ali's trillions of giants. However, although it has been a "maximum benefit", the soft-silver appears to have not been met. The "the largest shareholder" is being exposed to another "Ali" to be quietly built in Japan.

At the same time, the share price of Tencent, as" an old rival ", rose by 0.83%. As of now, the latest market value of this old "the king of the Hong Kong shares" is HK $3.26 million, which is a different "China Petroleum Co., Ltd." from Ali. "Who is the king of the Hong Kong shares," said the chief cofounder in the same competition with Tencent and Tencent. In the article, the "to hate and hate" of the "to be divided into one's own" of Alibaba and the Hong Kong Stock Exchange for 12 years has been reduced in detail. At the moment, with the return and market value of Ali, it is more straightforward with Tencent, who is the judge of the new "Hong Kong shares one brother".