(Picture Source:Sogou)

Ren Jinlong, general manager of Shenzhen Jinwutong Investment Co., Ltd., said: "at present, whether from the results of LeTV or from the evolution of the Letv incident, if we want to make its net assets positive through its profits, or through asset restructuring and debt restructuring, I think this is very difficult," said Ren Jinlong, general manager of Shenzhen Jinwutong Investment Co., Ltd. What's more, if LeTV wants to apply for a resumption of listing, it also needs to meet some other indicators, such as sound corporate governance, proof of its sustainable profitability, better internal control, no major violations of the law, and these are more difficult for LeTV. "

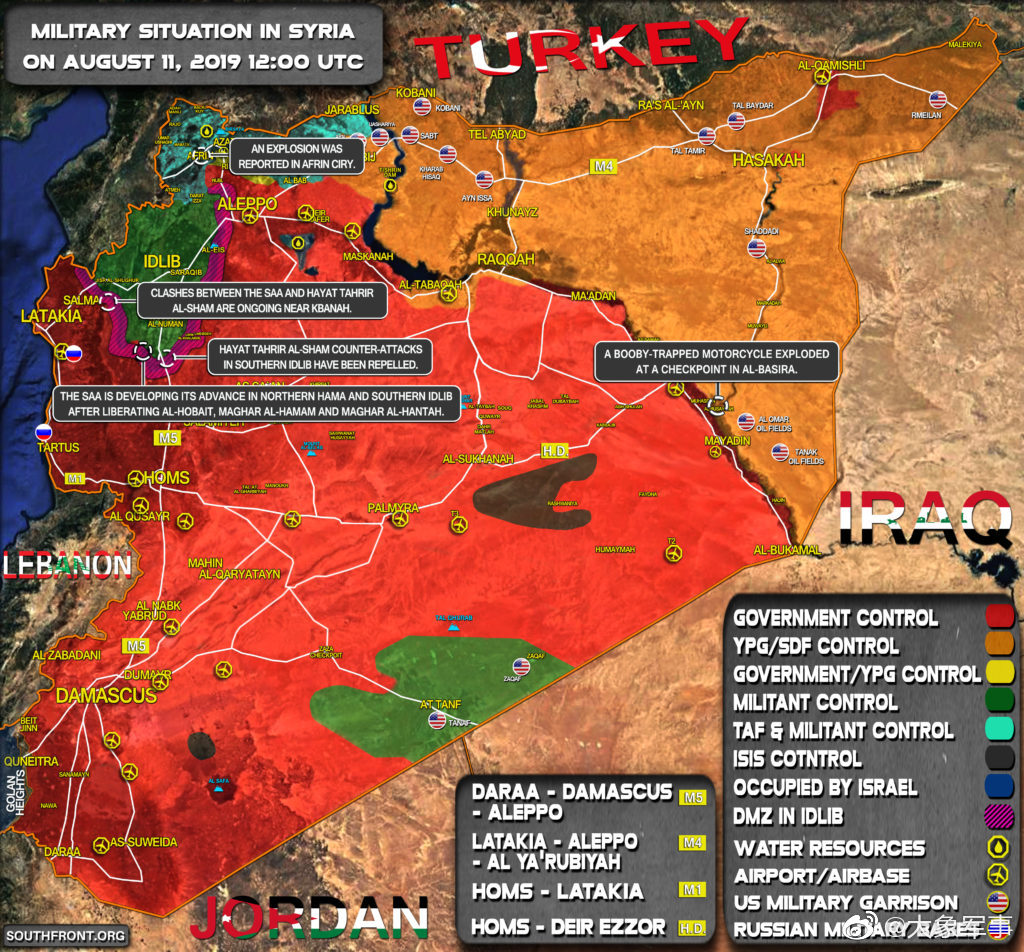

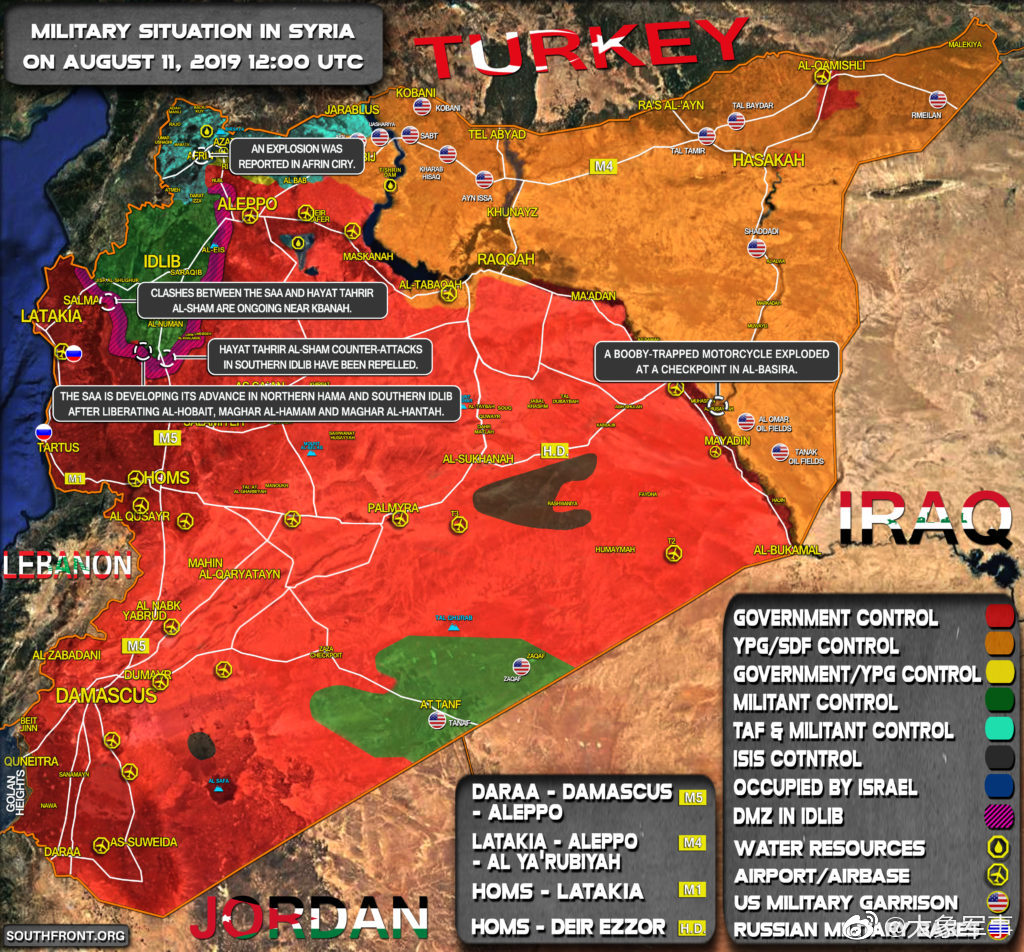

On November 10, 2004, Jia Yueting, a Shanxi businessman, registered and established LeTV Network Information Technology (Beijing) Co., Ltd. Subsequently, Letv's ecosystem developed rapidly and finally landed on the gem on August 12, 2010 to raise 730 million yuan. Since then, LeTV has begun its roller coaster-like ups and downs of 8 years of A-share career. On the first day of listing, LeTV closed 42.96 yuan, up 47.12 percent from its 29.20 yuan offering price, changing hands at 76.51 percent, trading at a dynamic price-to-earnings ratio of 68.9 times, with a total turnover of 707 million yuan. But at that time, there were views on the successful listing of LeTV. The response of LeTV at that time was that "it adopted the innovative business model of" paid free ", and the charging model contributed more than half of the total revenue, so it was able to take the lead in achieving profit and sustained rapid growth in the industry." at the end of 2014, Jia Yueting, based on LeTV, a listed company, opened up the radical expansion of Letv's ecology. Gradually build Letv's seven ecological sectors-Internet applications and cloud services, content, big screen, mobile phones, sports, cars, Internet finance. Since 2015, "ecological opposition" has been frequently mentioned in Letv's propaganda. However, after this, Letv began to have a frequent negative. news, such as the interruption of sports live broadcast, executives and employees have left and so on. The financial crisis finally broke out in 2017, and has yet to emerge from it. It is reported that due to negative net assets at the end of last year, in May this year, Letv was suspended from listing, one of the conditions for the resumption of listing is that the end of this year net assets must be positive. Years of huge losses, by the end of June this year, Letv net assets have been -13.089 billion yuan. Now, however, Letv is losing more than 100 million dollars again in the third quarter, and while the amount is down from a year earlier, the situation has not changed. From the secondary market point of view,2015. In May, the highest share price of LeTV was 44.72 yuan per share, when the total market capitalization was as high as more than 160 billion yuan. Before suspending the listing, LeTV shares closed at 1.69 yuan, with a total market capitalization of 6.741 billion yuan, plunging 96 percent from their highs. By the end of the second quarter of this year, LeTV had 280700 shareholders, according to the data.

Ren Jinlong, general manager of Shenzhen Jinwutong Investment Co., Ltd., said: "at present, whether from the results of LeTV or from the evolution of the Letv incident, if we want to make its net assets positive through its profits, or through asset restructuring and debt restructuring, I think this is very difficult," said Ren Jinlong, general manager of Shenzhen Jinwutong Investment Co., Ltd. What's more, if LeTV wants to apply for a resumption of listing, it also needs to meet some other indicators, such as sound corporate governance, proof of its sustainable profitability, better internal control, no major violations of the law, and these are more difficult for LeTV. "

October 22, LeTV issued a clarification notice, in response to Jia Yueting personal bankruptcy restructuring rumors. The announcement pointed out that since the outbreak of the operating crisis in 2017, Jia Yueting has repeatedly declared that he has pledged to repay, but there has been no actual guarantee action. Since August 2018, LeTV has held many negotiations with major shareholders and their related parties, but since the landing and implementation of the solution depends on the willingness and actual implementation of major shareholders, there has been no progress in the treatment of debt between LeTV and major shareholders and their related parties. The debt treatment team of the major shareholders and their related parties did not come up with a complete processing party that could be substantially enforceable In the case, LeTV did not receive any cash from the debt solution. At the same time, the announcement pointed out that Jia Yueting, as the actual controller of the company, should bear the responsibility of the major shareholders as soon as possible and come up with a feasible solution to the debt problem of related parties.