For some of the larger dairy farmers in the United States, the news over Dean's filing for bankruptcy protection has also added more uncertainty to the U. S. agricultural sector, whose profits have been diluted because of the price war and high supply. Wisconsin, the country's second-largest milk producer, has lost more than 800 cows in the past 12 months, according to data released by the U.S. Department of Agriculture in October.

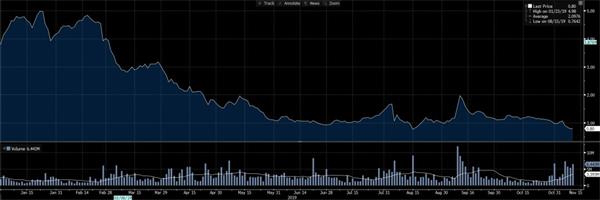

In addition, in the past eight quarters, in the past eight quarters, Dean has lost a seven-quarter loss, and some analysts expect Dean to continue to lose in 2020. Dean's sales in 2018 are $7.8 billion, a 38 per cent lower than a decade ago, and its share price has been hovering around $1 since May. In the beginning of the year, Dean's share price has plummeted by 79%, and it is the worst in the same industry that Bloomberg has been tracking. Dean's share price was reported to $0.8 as of November 11,2019.

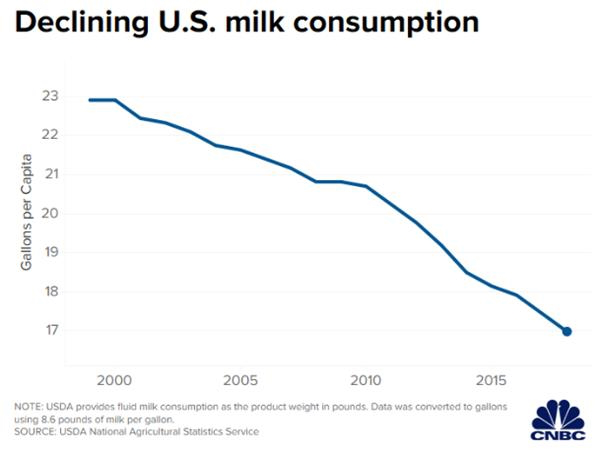

Cheap milk is a tool for many retailers to attract customers, which also puts profit margin pressure on Dean, which has also led Dean to invest a lot of money on his national brand DairyPure. U.S. consumers drank 146 pounds of milk per capita in 2018, the lowest level since the agency began recording the figure in 1975, according to the U.S. Department of Agriculture. In addition, the figure has fallen 39 percent in the past 40 years. At the same time, dairy consumption in the United States rose nearly 1% during this period as consumers bought more yogurt and cheese.

Monica Massey, executive vice president of DFA, which represents about 14000 dairy producers, said the association had been closely watching Dean's finances and had previously made financial preparations for the company's bankruptcy protection to minimize the impact. "Dean is an integral part of the dairy industry, and Dean is our biggest customer, accounting for more than 20 percent of DFA raw milk sales," said Monica Massey.

Dean listed up to $10 billion in assets and liabilities in court documents filed in Houston on the same day and said in a statement that existing lending institutions led by ABN Amro had pledged $850 million in bankruptcy protection financing, a form of financing for companies in financial distress. That is to say, consumers can still buy Dean's products.

According to the Wall Street Journal, Dean Foods Co. (hereinafter referred to as Dean), the largest milk copany in the United States, filed for bankruptcy protection under Chapter 11 of the US bankruptcy Law on November 12, US Central time, to maintain the operation of the business and solve the debt problem. It is also the latest setback in the US dairy industry struggling to cope with falling milk consumption and increased competition in the United States. As beverage sales shift to bottled aquatic products, juice and milk substitutes made from soy oats, Dean and dairy farmers have been trying to solve the problem of consumers staying away from traditional milk for years.

Dean company's history dates back to 1925, when it operated about 60 dairy processing plants in 29 states across the United States, setting up a production network by acquiring regional dairy companies over the years, making it the largest milk processor in the United States. In addition to serving dairy products for restaurants, supermarkets and schools, Dean also sells ice cream and dairy products. However, Dean's share price has fallen nearly 80% since the beginning of the year.

Dean has been trying to reduce the size of his U.S. production network for years, with the company estimated its total workforce at 15000 in March, down from 23000 a decade ago, the Wall Street Journal reported. However, due to Kroger Co., And (Albertsons Cos. Efforts by big retailers such as Dean to close underperforming factories and cut costs have failed to offset the decline in sales. In addition, Wal-Mart, one of Dean's biggest customers, opened its own milk producer in 2017 and sells Wal-Mart's own brand of milk in stores.

(Picture Source:Sogou)

In September, Dean Foods said it had completed its strategic review and decided to refuse to sell. Chief Executive Eric Beringause joined the company three months ago after becoming chief executive of dairy producer Gehl Foods, owned by Wind Point Partners, a private equity firm. Beringause said: "despite our best efforts to make our business more flexible and cost-effective, we continue to feel the impact of a challenging business environment marked by consumers. Milk consumption continues to decline. " It should be noted that Beringause is already Dean's third CEO. in the past three years.

Alan Bjerga, senior vice president of communications, a lobbying group, said in a statement to CNBC: "many national milk producers' federation member cooperatives provide milk to Dean Foods and may be affected by today's bankruptcy filing. We are collecting information to better assess the situation and will work closely with our members to provide all the support we can provide in the process. "

In the milk industry, Dallas-based Dean has struggled as a result of the price war at grocery chains and their own milk production plants. The Daily Economic News also noted that with the recent rise in U. S. milk prices, which has pushed up Dean's costs, the company has also been trying to close factories and cut costs as milk prices in the United States have risen 10 percent in the past three months.